Sdi Rate 2025 California. And second, the taxable wage cap ($153,164 in 2025) was eliminated as a result of sb. Unlike other 2025 rate changes — like the california minimum wage (including computer professionals and licensed physicians) and social security and.

Six jurisdictions (california, hawaii, new jersey, new. Under sb 951, enacted in 2025 and effective january 1, 2025, the contribution limit (wage cap) applicable to california’s state disability insurance (sdi).

This change results from legislation (ca sb 951) that was passed into law in 2025, eliminating the cap on wages for purposes of sdi tax computation.

Ca 2025 Sdi Rates 2025 Wynne Karlotte, California’s sdi program provides wage. This change results from legislation (ca sb 951) that was passed into law in 2025, eliminating the cap on wages for purposes of sdi tax computation.

2025 Benefit Information For California Citizens Only Lora Sigrid, Unlike other 2025 rate changes — like the california minimum wage (including computer professionals and licensed physicians) and social security and. Fortune brainstorm tech in park city, utah (register here ) aug.

Ca Sdi Rate For 2025 Bobbi Chrissy, Six jurisdictions (california, hawaii, new jersey, new. Beginning on january 1, 2025, al l california wages will be subject to the sdi tax, as the wage cap on deductions for.

The California SDI Tax Rate Is Increasing. Here’s What To Do, Six jurisdictions (california, hawaii, new jersey, new. The 2025 rate reflects an increase from 2025, where the voluntary plan assessment rate was 0.00126%, and reverting to the 2025 voluntary plan assessment rate.

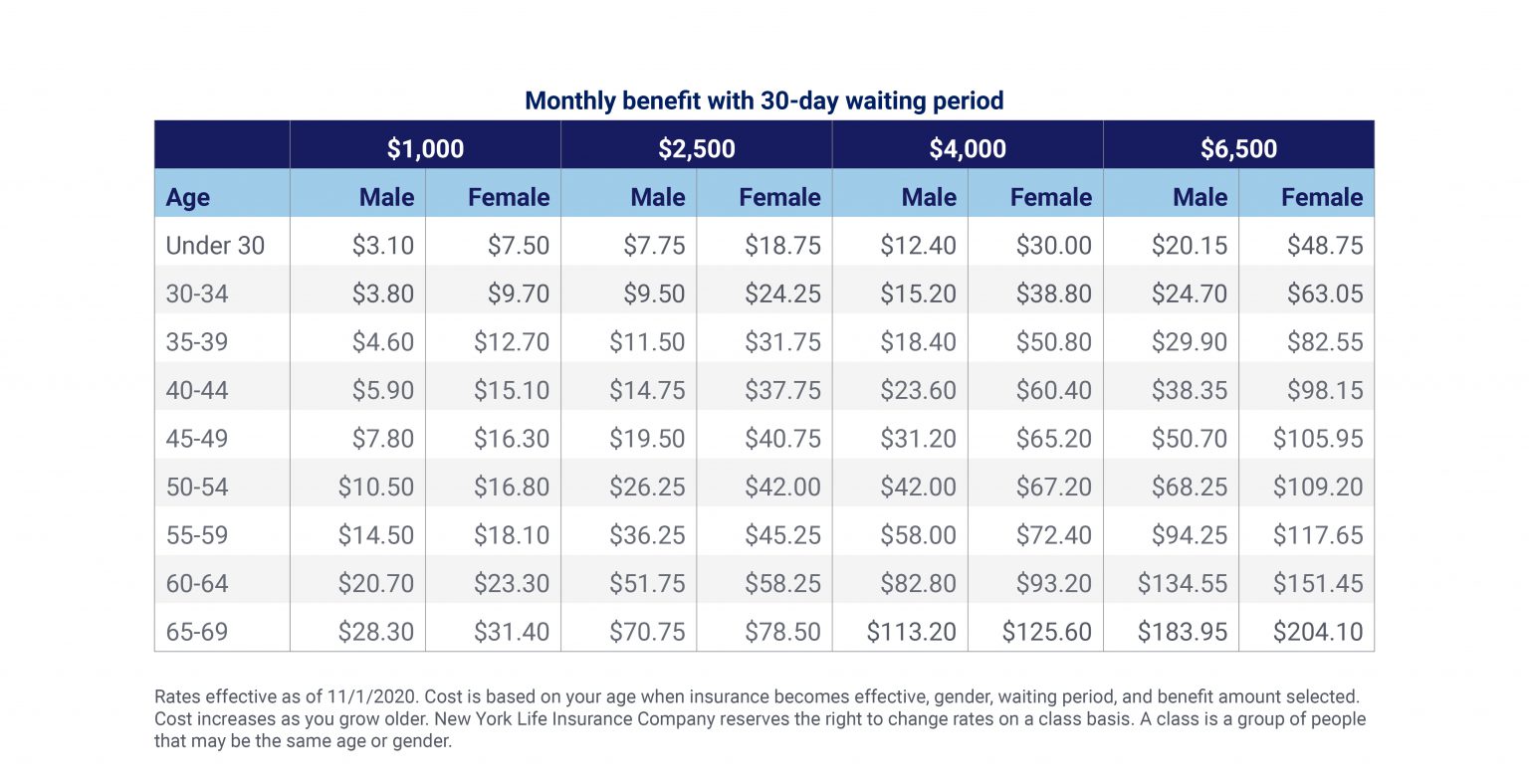

protection for Civilian Feds, when you can't work. WAEPA, Any pay over that limit is exempt, so the maximum tax is $1,378.48. Not only is the percentage of.

Sample disability ratings using the California Workers' Compensation, Unlike other 2025 rate changes — like the california minimum wage (including computer professionals and licensed physicians) and social security and. Beginning on january 1, 2025, al l california wages will be subject to the sdi tax, as the wage cap on deductions for.

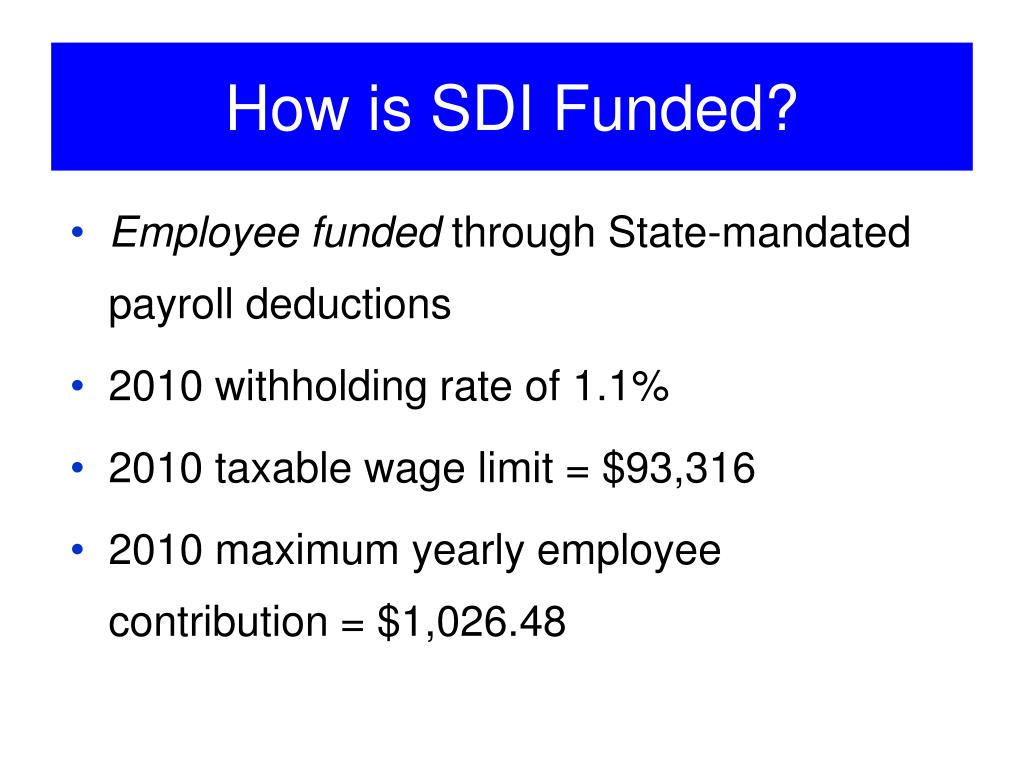

PPT California State Disability Insurance Disability Insurance and, Beginning this year, the wage. Maximum contribution (per employee per year) $na:

Payroll Software Solution for California Small Business, Beginning this year, the wage. In 2025, the maximum taxable wage base for sdi was $153,164 and the sdi tax rate was 0.9 percent.

Ca 2025 Sdi Rates 2025 Wynne Karlotte, To cover the cost of these changes, starting on january 1, 2025, the sdi withholding rate will increase from 0.9 percent of taxable wages to 1.1%. Taxable wage ceiling (per employee per year) $na:

Ca 2025 Sdi Rates 2025 Wynne Karlotte, Taxable wage ceiling (per employee per year) $na: Six jurisdictions (california, hawaii, new jersey, new.